Beneficial

Get a straightforward, fast service on-the-go. One document is all you need

Get a straightforward, fast service on-the-go. One document is all you need

A direct lender that values responsibility and innovation. We ensure your data's security and help in hard situations

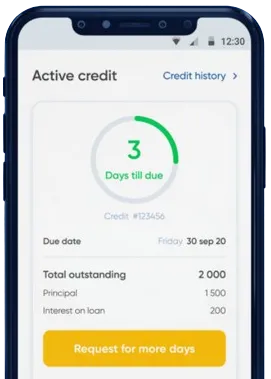

Easy and quick solutions without leaving home. Money is instantly transferred, with loan extension options

Place your request via our app, just by filling out the form.

Expect a decision in as little as 15 minutes.

Get the funds. Transactions are generally completed in one minute.

Place your request via our app, just by filling out the form.

Download loan app

Payday loans have become a popular financial solution for many South Africans. In recent years, paperless payday loans have emerged as a convenient and efficient way to access funds quickly. These loans are designed to provide short-term financial assistance to individuals who need it most.

One of the primary benefits of paperless payday loans is the convenience they offer. With paperless applications, individuals can apply for a loan online from the comfort of their own home. This eliminates the need to visit a physical branch or submit extensive paperwork, saving time and hassle for borrowers.

By streamlining the application process, paperless payday loans make it easier for individuals to access the funds they need in a timely manner. This can be particularly helpful in emergency situations where immediate financial assistance is required.

Another key benefit of paperless payday loans in South Africa is their accessibility. These loans are available to a wide range of individuals, including those with less than perfect credit histories. This makes them a viable option for individuals who may not qualify for traditional bank loans.

Furthermore, paperless payday loans are typically processed quickly, with funds deposited directly into the borrower's bank account. This means that individuals can access the funds they need without delay, providing a much-needed financial lifeline in times of crisis.

Paperless payday loans also offer greater flexibility compared to traditional loan options. Borrowers can choose the loan amount and repayment period that best suits their financial situation. This flexibility allows individuals to tailor the loan to their specific needs, ensuring a more manageable and affordable repayment plan.

With transparent terms and conditions, borrowers can make informed decisions about their loan commitments, empowering them to take control of their finances and avoid falling into debt traps.

In conclusion, paperless payday loans in South Africa offer a range of benefits that make them a valuable financial resource for individuals in need. From their convenience and accessibility to their flexibility and transparency, these loans provide a practical solution for managing short-term financial challenges.

Overall, paperless payday loans in South Africa are a convenient and efficient way to access funds quickly. With their online applications, quick approval process, accessibility, flexibility, and transparent terms, these loans offer a practical solution for individuals in need of short-term financial assistance.

Unfortunately, most lenders require applicants to have a bank account for the funds to be deposited into. However, there are some alternative lenders that may consider applicants without bank accounts.

With paperless payday loans, funds are typically disbursed within 24 hours of approval. Some lenders may even offer same-day payouts for urgent cases.

Typically, applicants must be South African citizens or permanent residents, employed with a regular income, and have a valid ID, proof of address, and bank account.

The loan amount varies from lender to lender, but it is usually based on the applicant's income and repayment ability. Generally, amounts range from R500 to R8000.

Yes, reputable lenders follow strict regulations to ensure the security and confidentiality of your personal information. It is important to do thorough research and choose a trusted lender.

If you are unable to make a repayment on time, you should contact your lender immediately to discuss alternative arrangements. Failure to repay may result in additional fees or legal action.